- Reporting of your Income Statement (P&L) based on structure the required by your company, with multiple and customizable P&L structures

- Balance Statement

- Direct cashflow statement

- Bank statement movements

- Vertical analysis where income statement values are shown as % of revenue, for balance sheet values are shown as % of assets and % of liabilities

- Horizontal analysis where you start January with 100, if it goes up 1% in February then it shows 101, etc.

- VAT reporting

- Ratios include liquidity, solvency, DSO, DPO and DIO

- For Accounts Receivable (AR) / Accounts Payable (AP) by all relevant dimensions

- Analysis of outstanding amounts per aging bucket based on historical snapshots data

- The most important Business Intelligence (BI) dimensions are GL account, customer (bill to/sell to/ship to), vendor, legal entity, division, business unit, currency, date, fixed assets, bank account, version (actual/budget), etc.

Thanks to these functionalities, you will be able to answer questions such as:

Is my working capital where I expect it to be?

Which cost centres will exceed their budget?

How are my Accounts Receivables and Accounts Payables evolving?

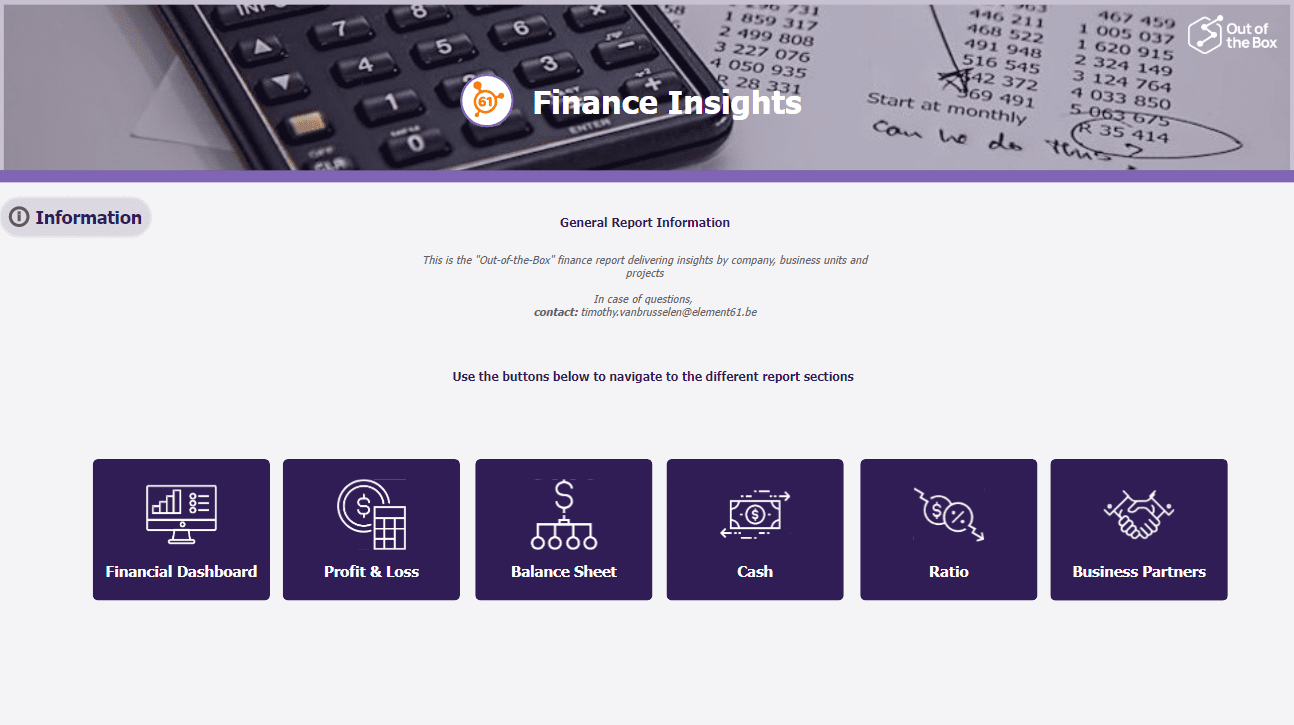

In short, our Power BI "Out-of-the-Box" Finance Analytics solution can focus on all the money-related activities of your company, thanks to the rich information from 7 integrated star schemas!